Start learning about TradesAI in minutes.

Welcome to the TradesAI documentation guide.

Click any of the sections below to learn how to use our premium toolkits and elevate your trading experience with TradesAI.

A. Trendlines

B. Market Structure Breakouts

C. Order Blocks and Reversal Order Blocks

2. TradesAI Premium Signals

1. TradesAI Premium Indicators

What is it?

TradesAI® (Premium) is an all-inclusive, premium indicator that focuses mainly on price action analysis, a form of looking at raw price data and market structure to analyze and capture areas of interest where price could react.. It leverages our proprietary Machine Learning algorithm (AI) to monitor and gauge price action according to many factors.

This indicator is a perfect trading companion that saves you a lot of time in trading price action. Some of the popular methods that use price action analysis are "Smart Money Concepts (SMC)", "Inner Circle Trader (ICT)", and "Institutional Trading".

POWERFUL TOOLS

The indicator combines three main tools as a trading suite:

A. Trendlines

B. Market Structure Breakouts (MSB)

C. Order Blocks (OBs) and Reversal Order Blocks (ROBs)

These 3 main tools are interconnected together. Below we go over each, and then explain how and why they are brought in together. Please also note that the indicator's settings have tooltips next to most of them, with more detailed information on TradingView.

A. Trendlines

This indicator automatically draws the most relevant Trendlines from pivot high/pivot low (based on the defined settings) as origins, while keeping track of candle closes across these Trendlines to adjust or invalidate accordingly.

The indicator will draw all possible Trendlines up to the maximum allowed by TradingView's PineScript. It uses a bullish pivot high candle to draw downtrends, and a bearish pivot low candle to draw uptrends. The algorithm will draw the most suitable active trendlines from those origin points.

The indicator takes the origin point as the first point of the trendline, then starts looking for the immediate next same-type candle (bullish to bullish or bearish to bearish), to draw the trendline between the origin candle and this newer candle.

An uptrend is a ray connecting two bearish candles, as long as the second candle has a low higher than the low of the origin (first) candle. A downtrend is a ray connecting two bullish candles, as long as the second candle has a high lower than the high of the origin (first) candle.

Upon drawing, the indicator then starts monitoring and adjusting this Trendline, by keeping the origin always the same but changing the second point. The goal is to keep reducing the slope of the Trendline till it is at 0 degrees (horizontal line). That then makes the Trendline "final". Note that you have the option to keep all trendlines or just show the final, in the settings.

So, the algorithm has 3 States for the Trendlines:

- Initial: not tested, meaning price hasn't yet broken through it and closed a candle beyond it, to cause a re-adjustment of this Trendline.

- Broken: a candle hard closed (opened and closed) across it but still, the direction of the Trend is maintained with a new Trendline from the same Origin – could be replaced (or kept on the chart as "backside", which is what we call a Broken Trendline to be tested from the opposite side) with a new Trendline from the same origin, to the newest candle that caused the break to happen, as then it becomes the new second point of that Trendline.

- Final: a candle hard closed (opened and closed) across it and can't draw a new Trendline from the same origin maintaining the direction of the Trend (so an uptrend becomes a downtrend or a downtrend becomes an uptrend at this point, which is not allowed). This marks the end of the Trendline adjustment for that origin.

To summarize the Trendlines algorithm, imagine starting from a candle and drawing the trendline, then keep re-adjusting it to make its slope less and less, till it becomes a horizontal line. That's the final state.

Here is a step-by-step scenario to demonstrate the algorithm:

Notice how first an Uptrend (green ray) is drawn between point A origin pivot (picked by our smart algorithm) and point B, both marked by green arrows:

Uptrend then turned into backside (where it flips from diagonal support to resistance where liquidity potentially resides):

Then a new uptrend is drawn from the same point A origin pivot to a new point B matching the filters in settings.

Finally, it turns also into a backside and is considered final because no more uptrends could be drawn from the same point A origin point.

Unlike traditional trendline tools, this indicator takes into account numerous rules for each candlestick to determine valid support and resistance levels, which act as liquidity zones.

What does it do differently?

Unlike conventional trendline tools, this indicator allows the user to define the pivot point left and right length to capture the proper ones as origins, then automatically recognizes and extends lines from them as liquidity zones where a reaction is expected. Moreover, the indicator monitors those trendlines in real-time to switch them from buying to selling zones, and vice-versa, as price structure changes.

Features of the tool

- Log vs. Linear scale switch to show different trendlines accordingly. When updating the Trendlines, or deciding whether Touches/Hard Closes are met, it makes a difference.

- Ability to show all forms of Trendlines, Final Trendlines or just Backside Trendlines.

Why is it used?

For experienced traders, it offers the advantage of time efficiency, while new traders can bypass the steep learning curve of drawing trendlines manually, which could practically be drawn between any two candlesticks on the chart (many variations).

How can it be combined with another tool?

This trendline indicator can be paired with our other trading tools such as Order Blocks or Market Structure Break levels. When used in conjunction, these tools can provide a more comprehensive trading strategy, enhancing the probability of successful trades.

B. Market Structure Breakout (MSB)

What is it?

The Market Structure Breakouts (MSB) tool is a trading tool that detects specific patterns on trading charts and provides ‘take profit’ regions based on the extended direction of the identified pattern. A breakout is a potential trading opportunity that presents itself when an asset's price moves away from a zone of accumulation (i.e. above a resistance level or below a support level) on increasing volume. The most famous form of Market Structure breakout is double/triple tops/bottoms, or what is referred to as W or M breakouts.

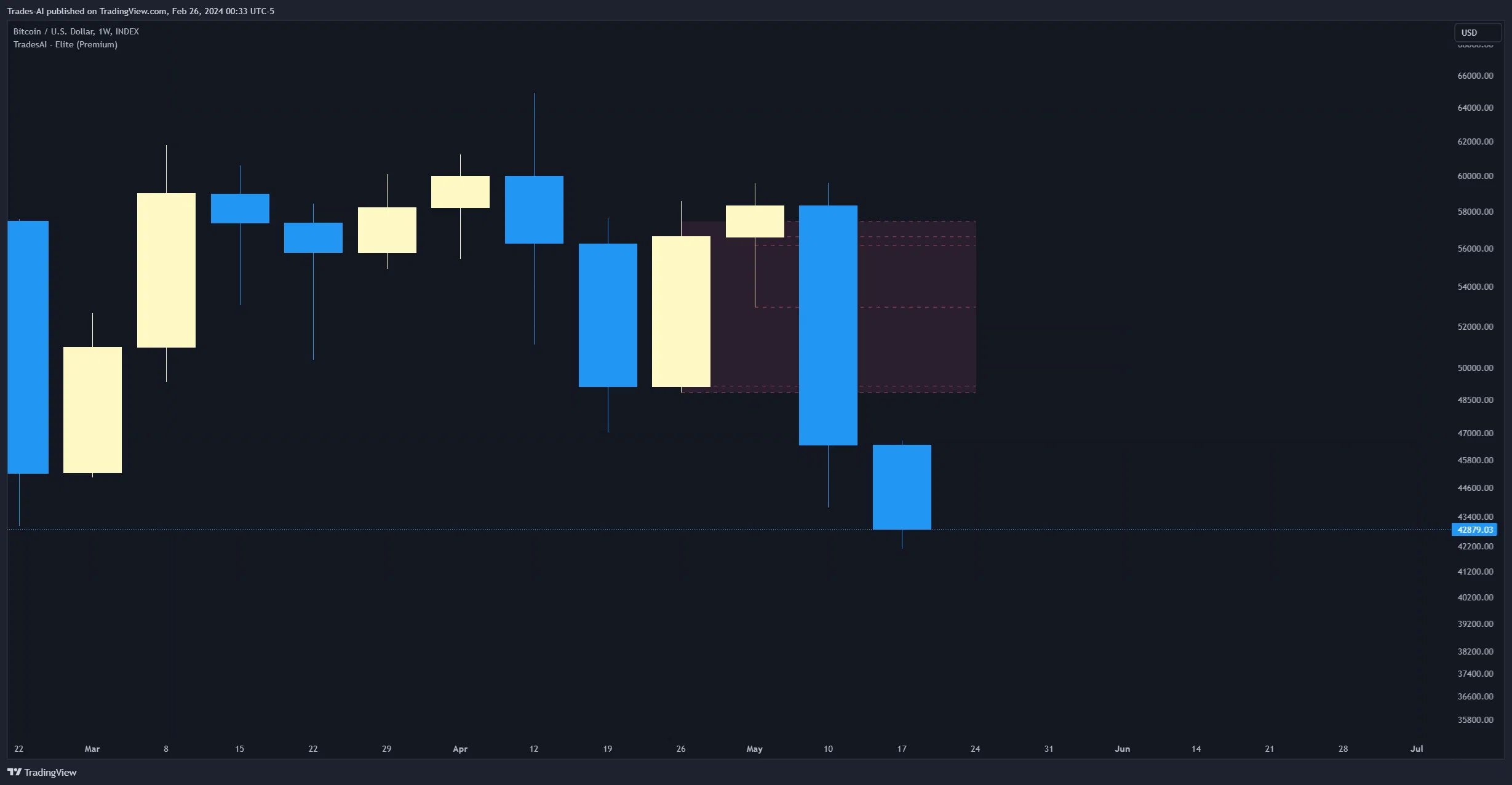

See this example below of how our MSB smart algorithm picked the local bottom of BTCUSD

Here is a step-by-step scenario to demonstrate the algorithm:

First, the algorithm picks the pivot points according to our Machine Learning (ML) model, which uses Average True Range (ATR) and Moving Averages of various types to decide. It will then signal a Market Structure Breakout (MSB):

You may either short (sell) this MSB towards the targets (dotted green lines) and/or buy (long) at the targets (dotted green lines). Usually, these targets provide scalp moves, according to our model, but they may also act as strong reversal points on the chart.

What does it do differently?

Unlike standard indicators, the MSB tool identifies patterns that may not appear in every time frame due to specific conditions that need to be met, including Average True Range (ATR) and Moving Averages at the time of creation. Once these patterns are identified, the tool gives ‘take profit’ regions in the direction of the trading pattern and even allows for trading in the opposite direction (contrarian/counter-trend scalps) once those regions are reached. A confirmed breakout has the potential to drive the price to these specific targets, calculated based on our Machine Learning (ML) model. The Targets are the measured moves placed from the breakout point.

Features of the tool:

- Log vs. Linear scale switch to show different MSBs accordingly based on the ratios.

- Detects trading patterns with specific conditions.

- Ability to specify how sensitive the pivot points are for capturing market structure breakouts.

- Provides take profit regions in the extended direction of the pattern.

- Allows for versatile trading styles by permitting trades in the opposite direction (contrarian or counter-trend) once the take profit region is reached.

- Highlights 2 levels of interest for potential trade initiation (or as targets of the MSB move).

Why is it used?

The Market Structure Breakout (MSB) tool is used because of its high accuracy in detecting specific patterns and providing precise take-profit regions. It offers traders the flexibility of versatile trading styles with tight invalidation.

How can it be combined with another tool?

The Market Structure Break Indicator can be combined with Order Blocks and Trendlines to create a powerful trading strategy. The confluence of detecting specific patterns from the indicator, along with the support and resistance levels from Order Blocks and the directional guidance of trendlines, can enhance the accuracy and reliability of trading signals. This combination offers traders a holistic view of the market, enabling them to make well-informed decisions and improve their trading success rate.

C. Order Block (OB) and Reversal Order Block (ROB)

What is it?

Before diving deeper into OBs and ROBs, you may consider the following chart for a general understanding of price ladders, and how they break. This is a bearish price ladder leaving Lower Lows and Lower Highs after an initial Low and High (L->H->LL->LH). Bullish ladders are the opposite (H->L->HH->HL).

In this bearish ladder case, notice the numbers representing the highs made (being lower). While this is a clean structure, markets don't always create such clean ladders, but you may switch to a higher timeframe to see it in a clearer form (usually, you will be able to spot it there).

In SMC or ICT concepts, the "Break Of Structure (BOS)" is pretty much creating a new lower low (LL) for the bearish ladder (and the creation of a higher high (HH) for the bullish ladder). By doing so, markets are grabbing liquidity below these levels and could either continue the ladder or stop/flip it. This gives you the context of how the ladder prints.

Price usually ends the ladder with a "Change of Character (CHoCH)", which represents a BOS (to grab liquidity) followed by an aggressive move in the opposite direction, which could lead the market to close the gaps and balance out. It is considered a good practice to then target liquidity in the opposite direction when a CHoCH happens, meaning for a bearish ladder you may target the pivots marked by 3, 2 and 1 at the top (start of the ladder).

Now we move to Order Blocks (OBs) and Reversal Order Blocks (ROBs). Think of them as sniper zones or micro ladders inside the bigger ladder/structure.

Order Blocks are usually used as zones of support and resistance on a trading chart where liquidity is present, or what some traders call "potential institutional interest zones". Order Blocks can be observed at the beginning of these strong moves of BOS or the CHoCH, leaving behind a zone (one or more candles) to be revisited later to balance the market. Therefore, these are interesting levels to place Limit/Market orders (sell the peaks or buy the valleys) instead of doing so at the swing highs or swing lows of the ladder (where BOS or CHoCH happened). The idea here is that the price could go deep into the ladder's step (peak or valley), and by doing so, it usually goes to these zones.

A bullish Order Block (Valley-OB) is the last bearish candle of a downtrend before a sequence of bullish candles (thus forming a "Valley"). A bearish Order Block (Peak-OB) is the last bullish candle of an uptrend before a sequence of bearish candles (thus forming a "Peak"). Our indicator captures the full range zones of the OB meaning not only the last candle but the sequence of same-type candles immediately next to it, which creates a zone, thus the name "OB/ROB Zone". Not only does the tool mark those levels on the chart, but it also has a smart tracking algorithm to remove the appropriate levels dynamically. It will monitor, candle by candle, what is happening to all the OBs/ROBs, and update them according to how they are being tested/visited (eg. weak testing being a touch, and strong testing being a touch of the same colour candle).

Bullish Valley-OB:

Bearish Peak-OB:

The indicator follows our concept of "Zone Activation" to determine whether to mark zones with dashed or solid lines.

If we take a bearish Peak-OB as an example, notice how it first gets drawn with a dashed red line (as the algorithm monitors how far the price moved away from the zone):

As price moves away (distance based on our Machine Learning (ML) model), it turns into solid lines:

Some people prefer to enter market orders or limit (pending) orders close to the zone, while others wait for it to hit. You may wait for these zones to turn into solid lines (meaning that the price made a decent move away from it before revisiting it). It depends on your trading strategy.

When Order Block (OB) zones break instead of holding the ladder, they turn into what we call Reversal Order Blocks (ROB); our algorithm of flipping these zones where price could react from the other side of the OB. Our algorithm monitor and highlight the most suitable ones to trade, based on +30 conditions and variables by our Machine Learning (ML) models. Examples of ROBs in the SMC or ICT trading community are a "Breaker Block", a "Mitigation Block" or a "Unicorn Setup". However, our algorithm filters the zones based on many factors such as ratios of price movement before, inside and after these zones, along with many other factors.

The algorithm monitors the ratios of how price moved into and away from the OB/ROB, as well as the type of move happening, to then filter the ones that are considered of high probability to break/not do a reaction.

A bullish Valley-OB (green) turns into a bearish Valley-ROB (neon red) where you may short (sell), while a bearish Peak-OB (red) turns into a bullish Peak-ROB (neon green) where you may long (buy).

Example of a bullish Valley-OB that turned into a bearish Valley-ROB:

What does it do differently?

The tool marks the Full Range Zones, as well as the Order Block (last candle in that Full Range Zone), to provide entry levels. Not only does the tool mark those levels on the chart, but it also has a powerful, smart tracking algorithm to remove the appropriate levels.

Unlike regular support and resistance levels, our indicator determines which Order Blocks are relevant, using distribution and accumulation candles. This ensures that they represent accurate levels of relevance on the chart. They are also color-coded based on their status, such as whether they have been tested or are untested.

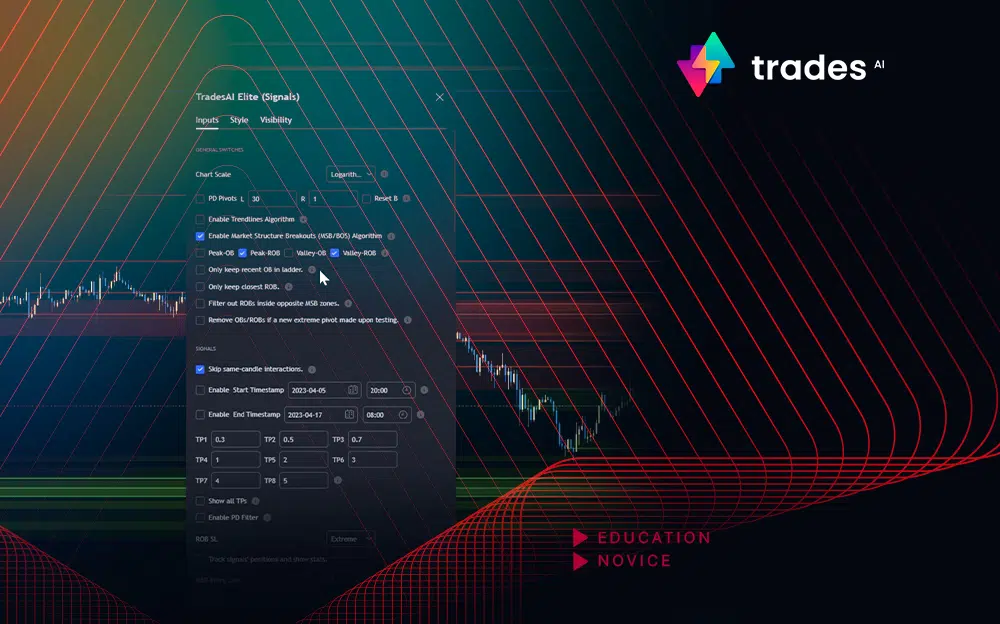

Features of the tool:

- Log vs. Linear scale switch to show OBs/ROBs accordingly based on the ratios and the price action around these zones (before and after creation).

- Uses our Machine Learning (ML) model to determine relevant Order Blocks (OBs) to show or hide based on price action.

- Considers distribution and accumulation candles to find relevant Order Blocks.

- Various types of triggers to mark those Order Blocks and their zones: breakout, close, hard close (open and close) or full close (low, high, open and close).

- Monitors the 1:1 expansion of price from key areas of interest, which would change the importance of the zones through our concept of “Zone Activation”.

- Allows for customization in the settings to display different types of Order Blocks (e.g., tested or untested).

- Marking and invalidating levels based on many variables, including single or multiple candle zones, touching/closing beyond specific levels, weak/strong testing criteria, price tolerance % (near a level), and many more.

- Provides color-coded visual representation for easier interpretation.

Why is it used?

Order Blocks (OB) and Reversal Order Blocks (ROB) represent the building blocks of price ladders, in conjunction with Swing Highs and Swing Lows. By identifying where liquidity is potentially present, they become common targets for big market players. Additionally, they provide clear invalidation points based on various types of candle closes, such as hard closes or simply a candle close.

One strategy that could be used is to open positions at these OB or ROB Levels as long as the chart maintains the trend (ladder), for a potentially higher win rate (or against it for a quick scalp). Be mindful of the breaking of a ladder or the building of a new one. A ladder breaks with a hard close (open and close) of a candle across the closest two levels; a ladder builds by not breaking back down across the levels it has tested. By definition, strong ladders will have a few untested levels and come back to wick them but still retain the structure of the laddering direction (trending with Lower Lows + Lower Highs or Higher Lows + Higher Highs).

How can it be combined with another tool?

Order Blocks can be combined with trendlines for trading. The intersection points of horizontal Order Blocks and diagonal trendlines can provide additional confluence, making them even more reliable indicators for trade setups. This combination helps in reinforcing the strength of the trading signal and provides traders with more confidence in their decisions.

COMBINING ALL TOOLS

In summary, trendlines could be great tools to give you a general context of whether the price is laddering up or down. Once you spot the ladder, your goal is to either trade in its direction (not to go against the trend) or to counter-trend trade (contrarian). To do so, you could use the MSB tool to spot these BOS/CHoCH. And to give you more precise entries, you may rely on the OB/ROB zones which usually mesh over the ladder, to provide a sniper entry!

BUY NOW BUY NOW

2. TRADESAI PREMIUM SIGNALS

What is it?

If you are looking for institution-grade, human-supervised trading setups, powered by our advanced Premium indicator, in addition to other algorithms in our backend servers, our Premium Signals Groups on various messaging and social media platforms (Telegram, Discord, WhatsApp, Instagram, etc.) broadcast full setups of Entries, Take Profits and Stop Losses for various assets including: stocks, indices, commodities, and cryptocurrencies. Our Premium Signals get delivered to you with detailed charts, comments from our senior trading desk's analysts, which you can take action on within your favourite exchange/broker, giving you the flexibility to take them as they are, or slightly adjust based on your strategies.

Our Premium Signals are provided for a wide selection of assets, with the ability to request additional assets as a member, so that our teams provide you with their trading setup signals accordingly.

RISK DISCLAIMER

Trading is risky, and most day traders lose money. The risk of loss in trading can be substantial. Decisions to buy, sell, hold or trade in securities, commodities and other investments involve risk and are best made based on the advice of qualified financial professionals. Past performance does not guarantee future results. All content is to be considered hypothetical, selected after the fact, in order to demonstrate our product and should not be construed as financial advice. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition.